Rollerskates, wheelchair and of course..

ROLLERHOUSE

I wish to use the term “Rollerhouse” instead of “Tiny House on Wheels” to make it a little easier. And point of the whole house is not the size, but the fact that it can roll. Just roll with it!

In this post I want to compare (roughly and recklessly) what it looks like in the bank account after 30 years with a mortgage for a immobile house (appartment, detached house, condo) versus a rollerhouse (home with wheels).

I am also using the currency of Euro (€) as Euro and Dollar are about the same. And 1 Dollar/Euro is about 10 Norwegian Crowns (NOK). And to make it easy for myself as I have already written it all in norwegian, I will just remove the last digit of all the numbers (or put in a comma) and put on a € (feeling so smart!). Hope you will enjoy!

To end the month with as much money in the bank as possible is what most people want. Money for food, travelling and things as well as money for unforseen expenses and to fill up a savings account. Economical safety is on top of the list for many people, but this doesn’t apply to every one. There are also those who work as much as possible to earn as much as possible so that they can show off a big house, cabins, cars, aupair to take care of the house, kids, food (and wife?), and when all the bills are paid, there is not a penny left. Month after month, year after year – but hey, look at all these nice things! From the outside he looks sooo accomplished – he HAS to be happy with all these things, right?!? And if this is you, then I am happy that you have found a lifestyle that suits you, and I hope there will never be a single unforseen event that will overturn the load!

However, if you are not too concerned with facades and things, then maybe time and financial security are. Or you are somewhere in between. Follow along, and we’ll look at a calculation.

But first I would like to introduce a new concept here on the blog that I choose to call

Posts in this category will deal with all cost-related aspects of having a rollerhouse, but which can also be general financial tips that more people can benefit from.

Let’s get to it!

______

There are an unlimited amount of things that can come into play during a 30 year period, but this post only focuses on a continuous mortgage of 30 years from start to finish and I will try to make it as simple as possible so that you can follow along.

Key information:

As housing interest is most likely to be increased to 4 – 4.5% already next year (2023), I choose to use 5% interest on the immobile house loan in this comparison.

Caravan loan (which is a rollerhouse loan) is currently at 5-6%, but I choose to use 7% interest here.

Equity is abbreviated to EQ.

Thousand is abbreviated to K.

Term amount is the monthly loan payment (installment + interest)

In the calculation, I have included the establishment fee, which is often (in Norway) 150€, and the installment fee, which is 5€ a month (a fee the bank must charge to allow you to pay your installment amount) (don’t ask me..).

Prices and starting point:

Immobile house:

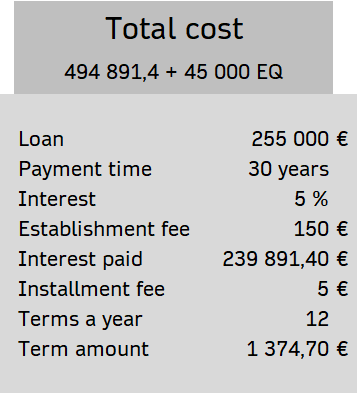

Price: 300,000€, 5% interest and the maximum downpayment time which is 30 years.

EQ: (minimum 15%) 45,000 € so the total loan is 255,000€

Term amount: 1,374,7€. After 30 years you are debt free and the house has cost (494,891,4 + 45 000,EQ)

Total 539,891,4 € after 30 years.

See the lineup below:

After 30 years you have paid

539,891,4 €

for the house that cost 300,000. Almost as much in interest as the whole loan itself!

Rollerhouse:

Price: 100,000 €, 7% interest and a maximum downpayment time of 10 years.

EQ: (20% for good interest and maximum time)

20,000 €, so the loan is 80,000 €.

Term amount: 935,6€. After 10 years you are debt free and the rollerhouse has cost (112,272,9 + 200,000 EQ)

Total 132,272,9 €

See the lineup below:

After 10 years you have paid

132,272,9 €

for your rollerhouse and will be debt free.

Are you following so far?

Quick facts to keep in mind:

1 year is 12 months

10 years are 120 months

30 years is 360 months

As paid monthly salary, I have chosen 3,000€ to use a round number and which may not be too far for many of us, at least not if there are two of you.

The first thing I want to show is how much money you have left after you have paid the term amount. That’s how much money you have to spare for the rest of the month for insurance, electricity, food, subscriptions and so on.

Immobile house:

3000 – 1374,7 = 1625,3

Rollerhouse:

3000 – 935,6 = 2064,4

We can already see that the rollerhouse has 439,1€ more to spare per month. Let’s put these numbers into a system to see what it looks like on the account after 1 year, 10 years and 30 years:

And this is what it looks like on the accounts after 1 year:

As we can see here, the rollerhouse has 5,269,2 € more to spend (and that’s a pretty nice vacation!) and in addition to that you are debt free in only 9 years!

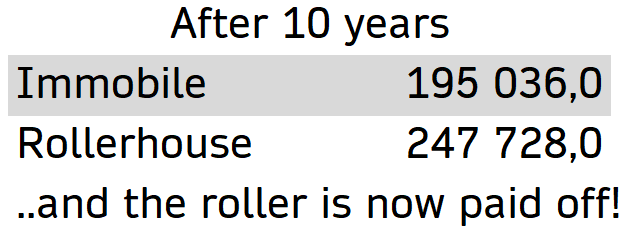

So, how about after 10 years?

After 10 years THIS is what it looks like on the bank accounts! The roller account has 52 692€ more than the immobile account AND the roller is now totally debt free! Hurray!

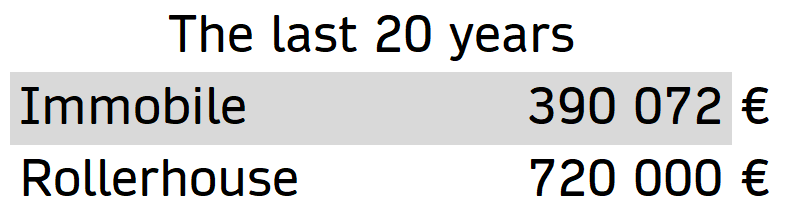

What about the last 20 years?

The rollerhouse has been debt free these last 20 years and has kept the total monthly income of 3,000 each month. The immobile house mortgage has kept on demanding 1374,7€ each month of it’s borrower.

The last 20 years show a significantly big difference in the accounts between the rollerhouse and the immobile house. Not only has the rollerhouse had the entire salary of 3,000 to enjoy every single month for the past 20 years, but also now has 720,000 in the bank, which is 330,000 more than the immobile house.

When we put together the first 10 years and the last 20 years, we get this: The immobile house has 585k while the roller has 967k in addition to have had no loan to pay the last 20 years. That IS a big deal!

Funfact:

If you bought the roller when you were 25, you would be debt free when you turned 35. In addition you now own your own house, designed to fit you perfectly AND that you can take with you if you decide to move.

Do you know anyone that lucky?

Point: The immobile home owner can sell his house and let’s say, get 600,000! Adding to his 585k = 1,185,000 in the bank!

Counterpoint: Yes, but then he has nowhere to live. And if he buys a house in the same market for 600k, he’s back in square one. In addition to having had less money each month than the rollerhouse. Aaand has paid a real estate agent 10k to sell his old house. And don’t forget all the stress involved in moving, searching for the new perfect house, the wait, the packing and so on.

Point: The value of the rollerhouse sinks with time.

Counterpoint: That’s most likely true, but will it make up for the fact that it costs less, makes you debt-free after a maximum of 10 years and generally gives you better finances and security in everyday life?

FUN FACT:

If you pay the same amount on the rollerhouse as on the immobile home (1374,7 a month), you will be debt-free in just 6 years!

But, it is a utopia to ONLY have a mortgage to pay in a month. Everyone has to have food, electricity, insurance, clothes, things etc., but in this post I wanted to show how what a huge difference there is between these two loans, and how much you have left every month and after 1, 10 and 30 years.

I also haven’t taken into account how much can go wrong in 30 years and needs to be repaired and maintained. Water damage can cost a lot of money, new cladding, a new roof, drainage and perhaps renovation of the kitchen, bathroom and other rooms? Thousands of euros will fly by quickly! The rollerhouse is brand new, and changing the cladding will most likely be cheaper than for a regular sized house.

Things the immobile has to pay that the rollerhouse doesn’t (in Norway, at least):

Municipal taxes (about 2k a year x 30 years =) 60,000

Property tax (if you have a house worth more than 570k.) The highest amount is 878 €.

Over 30 years the total is (30 x 878) 26,340 kr. The average is 350 a year. A boring payment.

Here are some numbers that might be a little fun to experiment with:

As we saw after 30 years, the immobile has approximately 585k in the bank and the roller had 970k.

What happens if we take into account some necessary monthly expences?

30 years is 360 months

500 (x360) for food is 180,000

200 for ensurances is 72,000

40 for cellphone14,400

60 i klær blir 21,600

1,800 for annual travelling is 54,000

FUN FACT:

To pay off the immobile mortgage in 10 years, you have to pay 2,711 € a month.

It really all come down to if you:

- Want to have more money in the bank every month and be debt free in 10 years

- Not have as much money each month, be in debt for 30 years but be able to sell your house in 30 years and earn alot of money to buy a new house with.

Advantages of a rollerhouse:

- Repaid loan in 10 years for only 900 per month (and I bet you can do it in less time!)

- You can buy it without any equity (max 8 years repayment period and a slightly higher interest rate)

- More money left over every month

- It is specially designed for YOU!

- Heating costs less

- Insurance costs less

- You avoid municipal tax, property tax

- Can take it with you and avoid all the moving-stress and 10,000 to the real estate agent

- After the house is paid off, only operating costs have to be covered and you can practically make a living selling heather at the bazaar two days a week (and who wouldn’t want THAT!?!)

A food for thought: If you had used the 45,000 EQ for the immobile house on a used rollerhouse instead, you would have been debt-free from day one, after 30 years you would have had 3,000 x 10 years = €1,080,000 in your account (for food, etc.).

What do you think about the difference between these two loans? I’d love to hear from you! Are there any other topics within the rollerhouse economics that you would like to read about?

Leave a comment and I’ll fix it!

Would love to hear from you!

Thank you so much for reading

Would you like a tiny house of your own? Check out The Tiny House Consultant!

Facebook page: Worlds Biggest Tiny House on Wheels

Follow me on YouTube: